CEM Member Experience Series

Learn how leading global pension plans

create great member experiences

Public Websites

Part 2: Life Events

The focus of this second issue in the CEM Member Experience Series is on how plans create an effortless experience on their websites via life events.

First, a reminder why your public website is important:

Life events is part 2 of our research on public websites.

1. Visual, structural and textual clarity

2. Life events

3. Self-service support

Life and career events are a great, simple starting point for websites.

Best practice: Life events are easy for your members to understand and highlight the key stages of a member's pension journey. Complexity is avoided in this first step. PFZW's website starts with 14 member journeys. Most are life and career events.

Only 37% of plans include a life event menu on their homepage in spite of its benefits.

The Dutch government's research on pension communication based on feedback from members, employers, regulators and pension plans is almost unanimous: Clear and personalized life-event driven messaging is the best way to engage members.

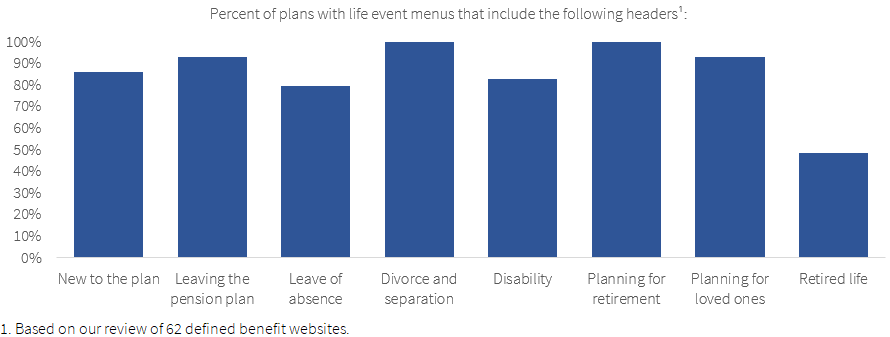

For the 37% of plans that have a life event menu on their homepage: We found that most plans define 8 life events. Two life events appeared in all menus: Planning for retirement and divorce. Planning for loved ones and leaving the plan were the next most prevalent life events, as shown below.

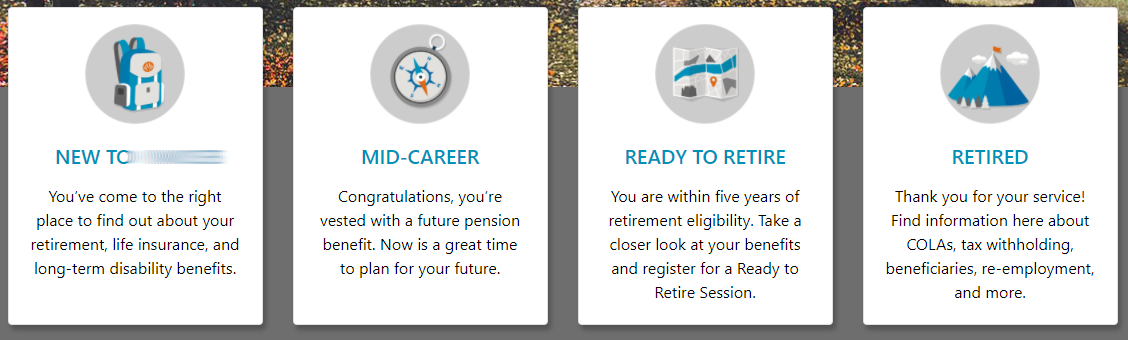

Some plans use the broader retirement journey as a starting point.

Practice to avoid: The plan below highlights four retirement stages and explains why they matter in plain language, which is good. However, the broader retirement journey is a sub-optimal starting point. Where does a member go if they had a divorce or a family member dies? These life events could apply to multiple categories below.

Your homepage can start with life events and the broader retirement journey.

Idea: The navigation menu on SHEPP's website opens with life events and different career stages. The menu header descriptions avoid legalese.

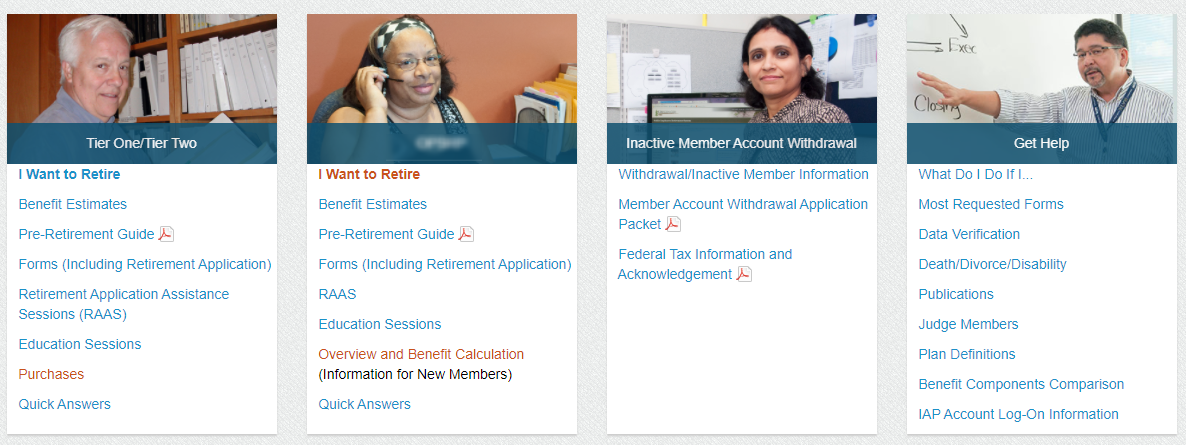

Most plans organize information by member type on their homepage, but don't include life events as a starting point.

Practice to avoid: Most pension websites frustrate members because the starting point isn't clear. The homepage overwhelms them with information, and introduces acronyms and legalese.

Many websites start with non-intuitive information on plans, tiers and benefits.

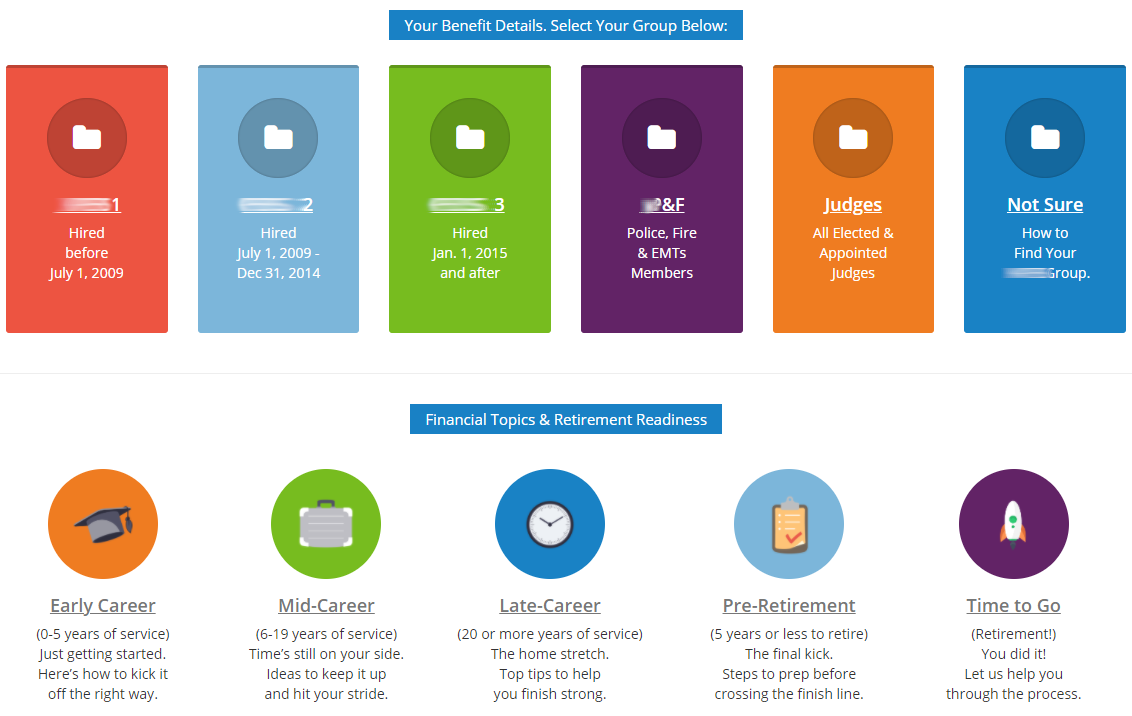

Practice to avoid: Where does a member go if they had a divorce in the example below? Do they need to identify what plan they belong to or where they are in their career?

In this example, the member can find divorce information via the 'mid-career' option or search the website for answers.

You can introduce plan, tier and benefit details in secondary steps - in the context of what the member wants to do.

Idea: In the example below, a PFZW member wants to know more about retirement. For all life events, their website will prompt the member to provide information by asking one simple question at a time. The first question isn't "What plan do you belong to?" Life events are the starting point. A subsequent question is, "When were you born?" to deduce what plan they belong to.

You can also introduce member groups and tiers via a start menu.

Idea: Wisconsin ETF's homepage provides easy, searchable member access to information on benefits. Their usability tests showed this was a pain point for members prior to their website rebuild.

Life events are a valuable feature in your primary navigation menu.

Best practice: If life and career events are not the starting point in the body of your website, they should be clearly visible in your primary navigation menu as one of the first headers.

Life events should be prominent on landing pages, not hidden in text or all organized on one page.

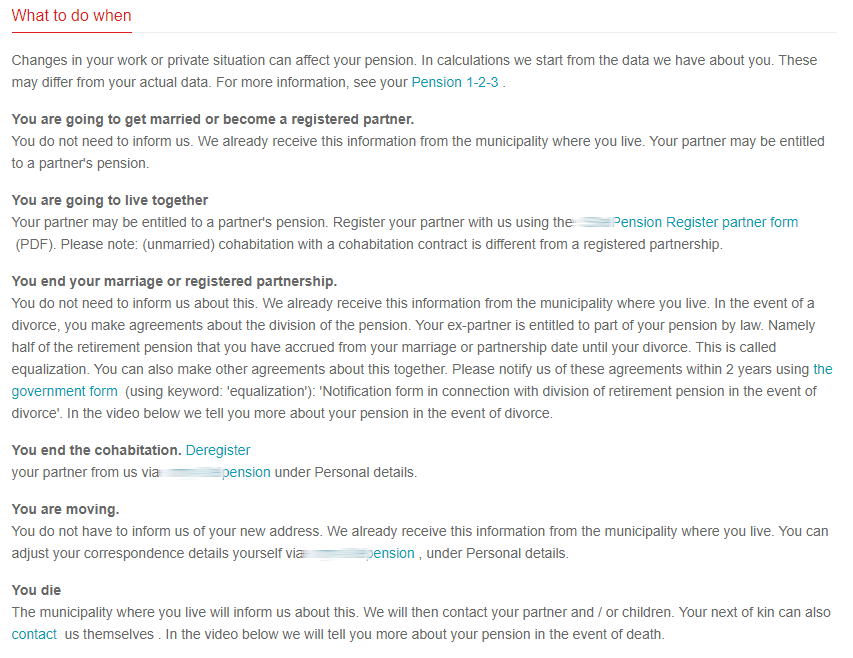

Practice to avoid: Don't include information for all life events and member types on a single landing page. You will frustrate the member with too much irrelevant information.

Categorize life event information in a logical way to make your member's life easier.

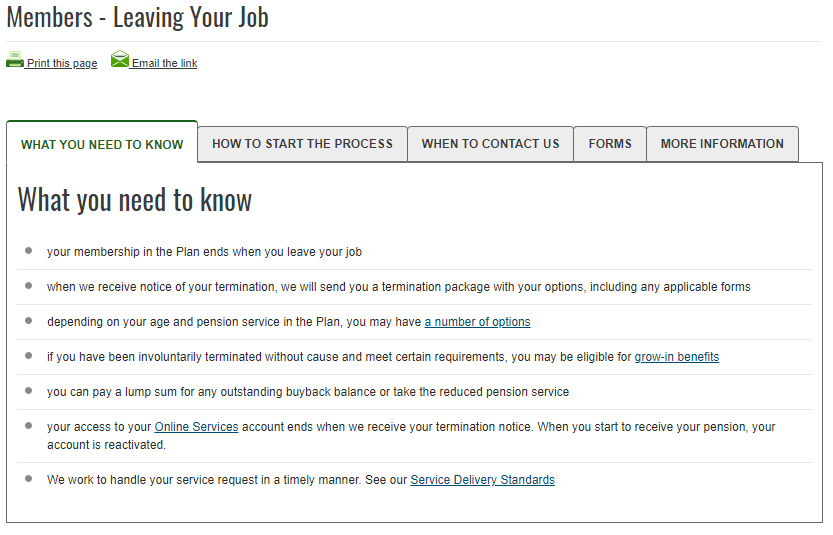

Best practice: OPTrust describes what you need to know, the process, when to contact them, forms and provide other information for each of their life events.

You may want to simplify information in your self-service channels, but all relevant information should be available online.

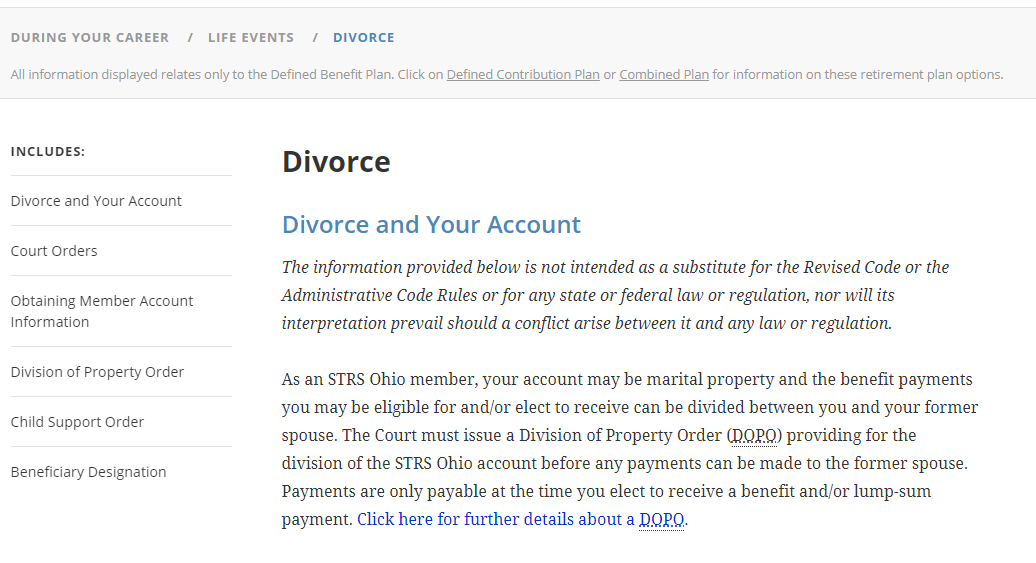

Best practice: Members should be able to find information online. You should be careful not to frustrate your members with rules and pension legalese. Good plans figure out how to present complex information in a simple way.

Take an omni-channel view: Self-service channels should complement other service channels.

Idea: You may want to withhold some information from your members to protect them from making sub-optimal decisions on their own, but ideally all information should be available online.

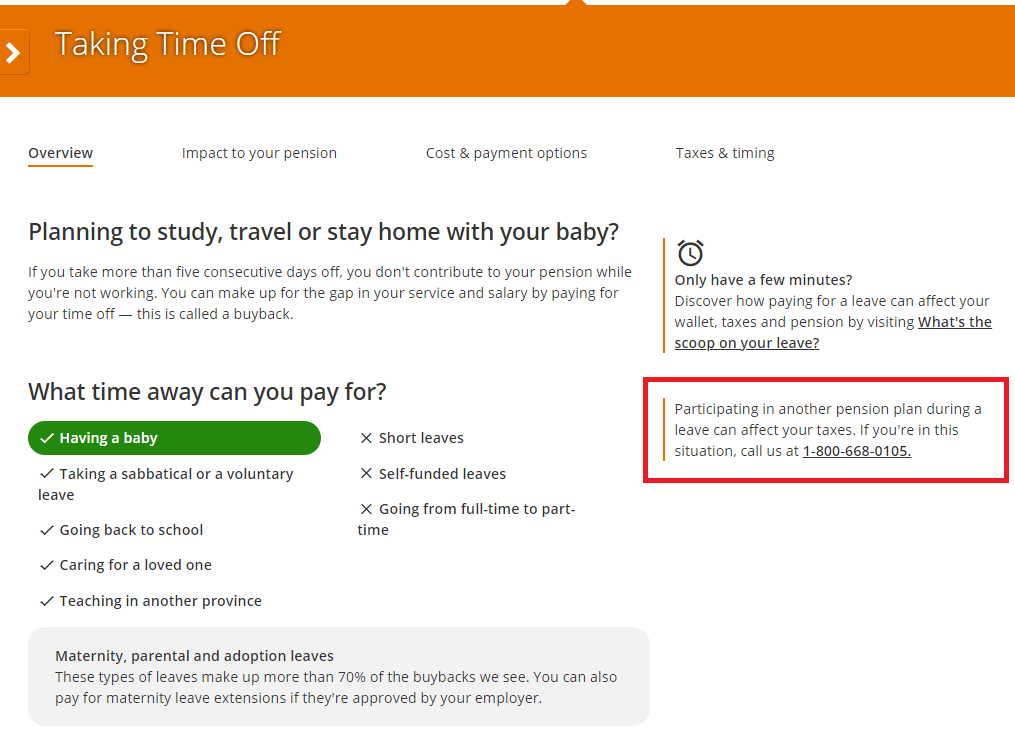

That said, some issues, like taxes, family law or survivor benefits, may be better discussed in person. Your self-service channels should direct members to the appropriate service channel. We have highlighted an example in the red box below.

Sell your members on the benefits of self-service with every chance you get.

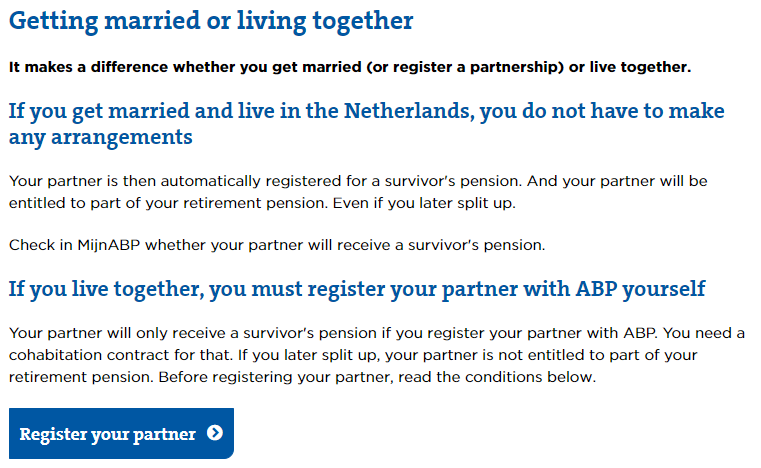

Best practice: Encourage self-service. Whenever you can redirect your members to the secure member area, tell them why they should. With a life or career website structure, you can describe what members can do online themselves (e.g., "check whether your partner will receive a survivor's pension" or "register your partner"). It is good practice to highlight key calls to action with color - the dark blue button below.

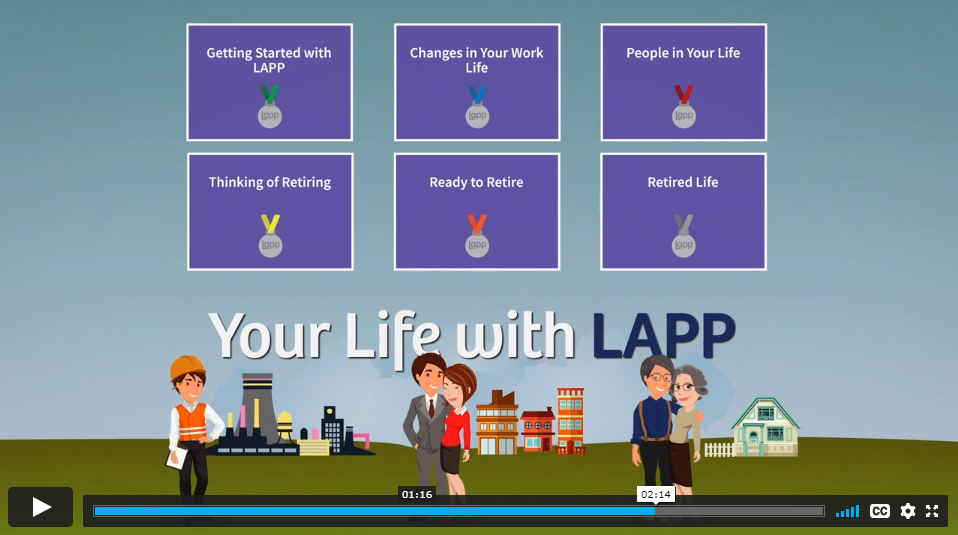

Some plans use fun videos to demonstrate the retirement at all stages of a member's life.

Idea: LAPP has a great educational video series for members. The material is presented so that it is easy to understand. Click on the video below to see how "Benny, LAPP’s pension guru, takes you on a quick tour of the LAPP website to learn where you can find everything you will ever need to know about your pension no matter where you are in your journey."

Ten defined benefit websites with good clarity and flow.

Most plans highlighted below can still improve, but may still be a good source for inspiration.

Click on the thumbnails below to visit the website. The websites for PFZW and ABP are in Dutch - most browsers will automatically provide you with a translation option.

How to access the rest of CEM’s public website review?

The rest of our public website review can be accessed via the links below:

Do you have a specific website question for your peers? Join the discussion on CEM's Peer Intelligence Network (PIN).

Copyright 2021 © CEM Benchmarking Inc. All Rights Reserved